All India Council of Technical Education invited degree holders for the AICTE Tax & Revenue Internship program. Interested bachelor’s degree holders who meet the eligibility conditions can submit the online application by following the step-by-step instructions given in this article. Candidates must check the information in detail before applying for the internship program including selection criteria, stipend, duration of the internship, and more. In this article, we tried to provide answers to all your questions related to the internship program.

About AICTE Tax & Revenue Internship

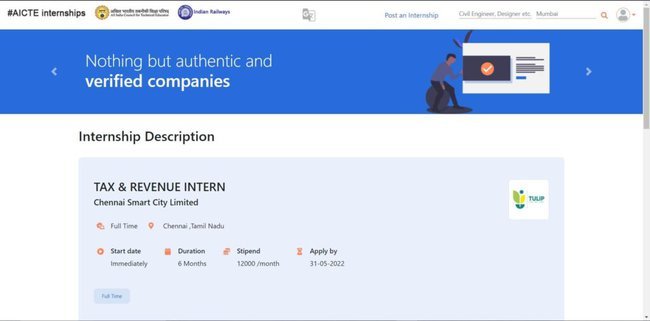

AICTE Tax & Revenue Internship program gives the opportunity to the applicant to work with Chennai Smart City Limited. The location of the internship is Chennai, Tamil Nadu. The duration of the program is of 6 months only. The interns would assist the Greater Chennai Corporation and Chennai Smart City Limited in the assessment of current tax policies, study existing municipal laws on taxation and suggest reforms. Moreover, interns would have to prepare periodic reports and data analyses on tax and revenue components.

Also Read: AICTE MERN Typescript Developer Internship

Highlights Of AICTE Tax & Revenue Internship

- Name of the scheme: AICTE Tax & Revenue Internship

- Launched by: All India Council of Technical Education

- Launched for: students

- Mode of application: online

- Last date: Update Soon

- Official site: AICTE

Objective Of AICTE & Revenue Internship

The objective of the All India Council of Technical Education behind the internship program is to provide work opportunities to recently passed students in a real working environment.

Benefits Of AICTE & Revenue Internship

- The applicant will get the chance to work with the Greater Chennai Corporation and Chennai Smart City Limited for about 6 months

- Applicants will get a monthly stipend of rupees 12000 per month

- Applicants will get the key project management, financial planning, urban governance, and more.

Eligibility Criteria

To get this internship opportunity applicant must hold B.A. (Hons.) degree and have relevant interests and skills.

Documents Required

- Passport size photograph

- Degree certificate

- 10th standard passing certificate

- 12th standard passing certificate

- Aadhar card

- Other significant documents

Important Dates

- The end date to submit the online application will update soon

Also Read: AICTE Tulip Finance Internship

AICTE Tax & Revenue Internship 2023 Application Procedure

- To apply for the Tax & Revenue internship program you have to visit the AICTE website of AICTE

- Now you have to look for the Tax & Revenue Internship or directly click here

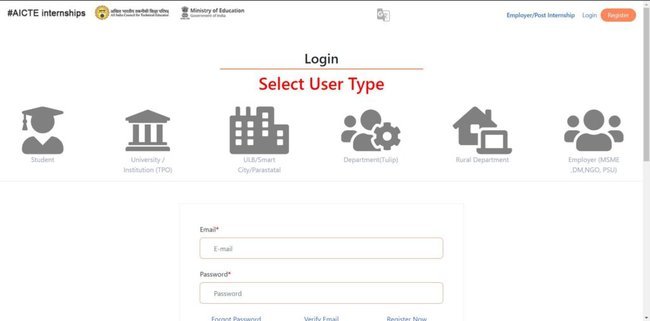

- Select apply now button to open the login window

- A new page will open, choose the register now option

- The registration form will open on the screen, fill out the form

- University/ college/ Institute name

- University/ college/ Institute type

- Institute State/ UT

- Institute city

- HOI number

- Region

- Candidate Name

- Email ID

- Password

- Security question etc

- Hit the register button and complete the registration by following the screen

- Log in with the portal and complete the further application by entering the rest details

- Upload the documents as required in the prescribed format and size

- Submit the application form by hitting submit button after carefully checking the details you entered